Last year posed many challenges in our market and many of those factors continue to flow into 2024. While there are signs of light at the end of the tunnel for this hard market, we still see challenges ahead before we make our way out.

This review outlines what we’re seeing in our market space, so you have a more comprehensive understanding of each trend. We’ll also equip you with actionable steps to take to optimize your insurance programs and mitigate potential risks. We will make sure to cover the following market impact topics:

• Social inflation and nuclear jury verdicts

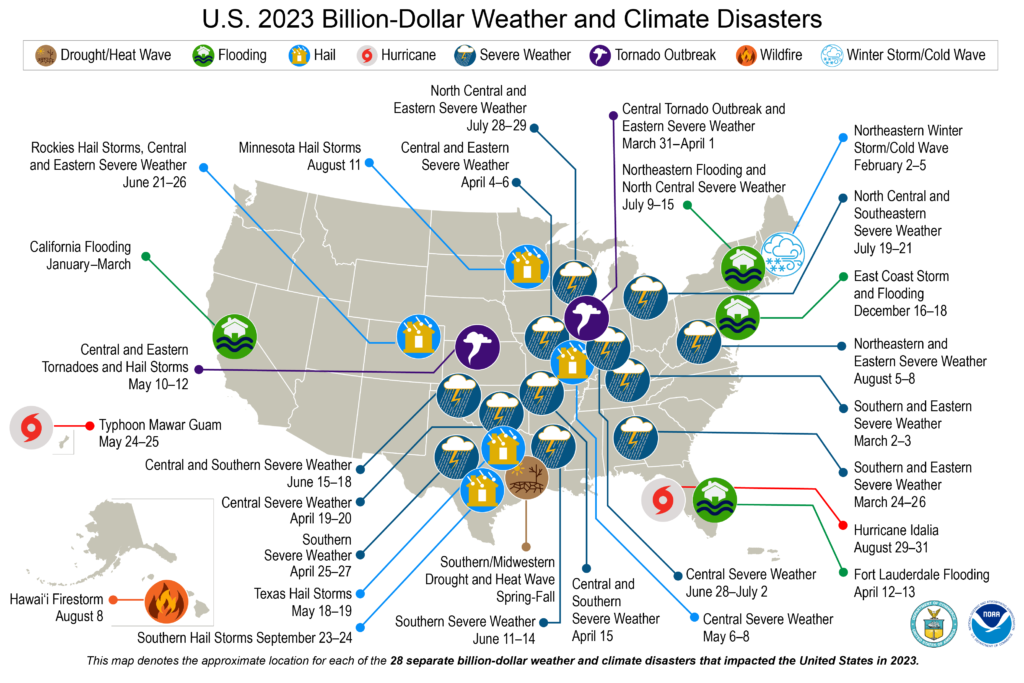

• Climate change and catastrophic weather events across the US and the rise in reinsurance costs

• Non-weather water-related plumbing losses

• The increasing cost of labor and building materials and continued supply chain issues

• A shift in how our clients are spending their money including increased investments in home renovations and additions and diversifying collectible assets such as jewelry, fine art, collectibles, and wine and spirits

• Check washing and what to do about it.

Out of all of this, it is important to highlight the growing value of comprehensive risk management strategies for high-net-worth individuals. With increasing wealth comes a greater need for protection against potential risks and liabilities. We are here to offer professional advice to identify and mitigate potential risks and offer tailored insurance policies to address these concerns.

Exposure: Nuclear Jury Verdicts

In a recent wealth report conducted by Chubb, 92% of those surveyed are concerned about the size of a verdict against them if they were a defendant in a liability case which can have profound implications for high-net-worth individuals yet only 36% have umbrella or excess liability coverage. Tailoring liability coverage to address potential legal ramifications is crucial in mitigating this risk.

What to do:

An excess liability or umbrella policy limit is meant to adjust as your lifestyle changes. Liability limits should be reviewed frequently to make sure that an adequate limit is in place. This is a crucial risk transfer tool that can help to protect your net worth and future earnings. The cost is generally nominal for what you get in return. Given the increase in nuclear jury verdicts, now is the time to review.

If you serve on any not-for-profit boards or host events at your property, let’s discuss to make sure proper insurance is in place and we can discuss best risk management practices in these scenarios.

Exposure: Climate Change and the Rise of Reinsurance Costs

High-net-worth individuals are not immune to the increasing frequency and severity of catastrophic weather events. From wildfires to severe weather, these events pose a significant threat to property and assets. Understanding regional risks and tailoring insurance coverage accordingly is vital. It’s not just about hurricanes along the coast or wildfires in California. Tornadoes are touching down in areas that they historically have not, where it rains, it can flood, and wildfires are happening across the country.

These catastrophic events are impacting the reinsurance market causing higher premiums which, in turn, impact the need for rate for the insurers.

What to do:

Make sure you’re leveraging the rest of your personal insurance policies with one carrier to see if you can obtain more advantageous terms and take proactive measures to make your homes more resilient:

For wildfire:

Have an annual contract with landscapers and arborists to make sure that trees are trimmed back from your home and that your property is well groomed from dry native brush. Keep combustible materials away from the structures. For those in extreme high brush areas, there are many additional proactive measures that we can address so please give us a call to have a more in-depth discussion.

For hurricane prone areas:

If you don’t have hurricane shutters or hurricane impact rated windows, doors, and garage doors, consider these updates as they can make your home more hurricane resilient but also provide credits on your home policy with wind coverage or open additional coverage opportunities. If it’s time for a roof replacement, talk to your advisor and contractor about what it would take to bring the roof up to code and what new features are available.

If you have a lender on your home and you have homes elsewhere in lesser catastrophic prone areas, discuss what your lending options are. If it fits within your financial plan, paying off the loan on your coastal property can have its advantages if it makes sense to self-insure the wind and/or flood exposures. These should be discussed in detail as not having coverage for these exposures should there be a hurricane and significant damage to your property could result in significant out of pocket expenses but can provide premium savings on your insurance portfolio.

Severe convective storms:

These are happening across the country and causing wind and water damage. Flooding can happen anywhere, and you do not need to be in a high flood zone to experience severe water damage to your home. If construction and/or developments have been built around your home recently or there is a lot of concrete near your home, water can accumulate quickly with nowhere to go.

What to do:

Review your flood insurance options. This is not automatically covered by your homeowners policy. It can either be added as an endorsement or written as a separate policy.

Exposure: Non-Weather Water-Related Home Losses

Water damage from non-weather-related incidents, such as a leaking pipe, a frozen burst pipe or appliance malfunctions, has become a prevalent trend for homeowners, including high-net-worth individuals. This type of water damage ranks as the second most prevalent cause of insurance claims. These incidents can result in substantial financial losses pushing clients out of their homes for extended periods of time while repairs and renovations are completed.

What to do:

We strongly recommend installation of a water leak detection shutoff device. This device is installed at the main plumbing valve in your home and/or guest house and monitors the flow of water coming into the building. If it notices an abnormal flow of water that would suggest a slow leak or a burst pipe, it shuts off the main plumbing supply line and sends an alert to your phone so you can locate the cause of the issue and alert a plumber that a repair or review is needed. By shutting off the water, it can give you peace of mind while you are on vacation or out for dinner and prevent severe water damage where you would have to move out of your home while repairs are being made. Unplanned renovations can seem like a whole other full-time job and can be very disruptive to your regular day-to-day and preventing this is priceless.

If you think you have a loss, please call us so we can discuss it. Accidents happen and we can help to expedite the claims handling process if it needs to be turned in and talk to you about next steps on immediate action items and what vendors to consider if you’re unsure who to call first.

Exposure: Underinsurance Caused by Inflation, Cost of Labor, and Supply Chain Issues for Building Materials

Inflation, coupled with escalating costs of labor and building materials, directly impacts property replacement values and can leave clients underinsured, in some cases, in the cost of repairs if a claim occurs, and the time needed to make those repairs. In addition, a home under construction faces increased risks that should be addressed including increased liability exposures with more foot traffic on your property and a higher likelihood of loss while contractors are updating plumbing or using flammable materials.

What to do:

If you are thinking about or recently completed renovations or an addition to your home, it is important to ensure your coverage adequately reflects the current replacement cost to avoid underinsurance. Open communication with your advisor can aid in maintaining accurate coverage. Talking with your advisor about renovations before they happen can also better prepare you for the increase in exposures and ensure that you’re fully covered while the work is being completed. Insurance contracts have varying language addressing undisclosed renovations and how that may impact a payout should there be a loss.

If you’re seeing an increase in premium from increased coverage limits and rate increases, consider higher deductibles if you have a higher tolerance for self-insurance on the smaller losses. Let the insurance policies help to protect you from more severe, large losses that could be a financial burden.

Exposure: Diversification of collectible assets without updates to valuable article policies

We are seeing a shift in how our clients, including those with a high net worth, are spending their money and we are seeing many diversifying their collectible assets such as jewelry, fine art, collectibles, and wine and spirits. All homeowner policies have a cap and limitation on higher valued items such as jewelry, firearms, and other valuable articles and they are also subject to the homeowners deductible.

What to do:

If you’ve made sales and/or purchases, please discuss with your advisor to make sure your policy is up to date. Adding or adjusting a valuable articles policy to your specific needs is a relatively quick adjustment and can be done at any time during the policy period on a prorated basis.

Make sure your appraisals are up to date. If your jewelry, fine art, or other collectibles haven’t been reviewed in the last five years, it may be overdue. If increased values are warranted, we can send the appraisals over to the company to increase.

Exposure: Check washing

We are seeing an increased number of check washing incidents. What do we mean by check washing? It’s when a thief steals your written check from the mail, washes the payee and, also, possibly, the dollar amount on the completed check and changes it to be written out to someone else aside from who it was intended for. You find out because you checked your bank account and find that it was deposited but went to the wrong person.

What to do:

Here are a few tips on how to avoid this:

• Pay your bills online.

• Check washing and what we need to do about it.

• Don’t leave mail in your mailbox; drop it off directly at the post office or place it in your mailbox right before your mail person comes.

• Use a blue or black non-erasable gel pen as these may have ink that makes it harder for the thief to wash out and replace.

• Check your bank account frequently for suspicious or fraudulent withdrawals.

• Contact your bank immediately.

Summary:

All of these exposures have impacted the insurance industry by constricting capacity, causing rate inadequacy for the insurance carriers and stricter guidelines on when, where, and how they are offering terms. As a high-net-worth individual, It is paramount now more than ever to have a knowledgeable advisor helping you navigate through all of this and to adjust where necessary. If you have questions on any of these and want to talk about anything in more detail, let’s chat! We love hearing from our clients and can make necessary adjustments, where needed.