The risk and insurance landscape for high-net-worth individuals (HNWIs) is rapidly evolving due to legal, economic, and environmental changes. From the rise of nuclear verdicts driving liability exposures to increasing material costs affecting home valuations, strategic insurance planning has never been more critical to protecting high-net-worth assets. Additionally, catastrophic weather events, shifting real estate dynamics, and the ripple effects of disasters like last year’s hurricanes and the Palisade and Eaton wildfires demand a reassessment of coverage strategies.

This overview outlines key areas of concern and solutions to ensure that HNWIs maintain robust financial protection against emerging risks:

- The Growing Need for Umbrella Liability Coverage Amid Nuclear Verdicts

- Adjusting Home Valuations to Address Underinsurance Risks and Insuring High End Vehicles with Appropriate Replacement Cost Coverage

- Investing in Home Resiliency to Mitigate Catastrophic Weather Risks

- Flood Insurance Trends & Rising Exposure Risks

- Shifts in the Real Estate Market & Their Insurance Implications

- Insurance Market Adjustments Post-Palisades and Eaton Wildfires

Deep Dive: The Risks in Detail and Solutions

1. The Growing Need for Umbrella Liability Coverage Amid Nuclear Verdicts

Understanding the Risk

Nuclear verdicts—jury awards exceeding $10 million—are on the rise, particularly in cases involving personal liability, auto accidents, and premises liability. Plaintiffs’ attorneys increasingly target individuals with substantial assets, leveraging social inflation and jury sympathy to secure massive settlements.

Why Standard Liability Coverage Is Insufficient for Protecting High-Net-Worth Assets

Most primary home and auto insurance policies offer liability limits between $300,000 and $500,000, an amount that is often inadequate in the face of today’s legal climate. One severe accident or lawsuit could result in financial devastation if assets are not properly protected.

Solution: High-Limit Umbrella Policies

An umbrella liability policy provides excess coverage beyond home and auto policies, ensuring financial security against high-stakes litigation that can threaten high-net-worth assets. For HNWIs, policies with limits of $5 million to $100 million are available, depending on asset exposure and risk profile. If limits have not been reviewed in the last few years, now is the time.

2. Adjusting Home Valuations to Address Underinsurance Risks and Insuring High End Vehicles with Appropriate Replacement Cost Coverage

Homes:

The Rising Cost of Rebuilding

Within the last five years, we have seen a surge in construction costs post pandemic and, most recently, with tariff uncertainty causing overall construction costs to increase roughly 40%. Many factors driving this include:

- Supply chain disruptions impacting building material delivery timelines and costs.

- Labor shortages inflating contractor expenses.

- Increased demand following natural disasters driving up rebuilding costs.

The Underinsurance Problem

Many HNWIs fail to regularly adjust their home insurance coverage to reflect these market shifts, especially after renovations and additions, leaving properties significantly underinsured. This discrepancy becomes painfully clear when claims settlements fall short of actual reconstruction costs.

Solution: Appraisals & Guaranteed Replacement Cost Coverage

- Appraisals post issuance for new policies and updating your insurance advisor of home improvements ensure that insured values reflect current rebuilding expenses. It is important to note that replacement costs are calculated differently than market value costs.

Guaranteed replacement cost policies cover full reconstruction costs, even if they exceed policy limits.

Cars:

New Technology Impacts

Newer, high-end vehicles have similarly seen pain points on the insurance front making it important to insure appropriately. The conveniences of high-tech smart car features and the evolution of electric vehicle technology has significantly impacted the repair costs and components that go into your new vehicles – and how insurance companies need to respond.

Solution: Premium Insurance Coverage and Flexibility to Choose the Right Body Shop

- Choose an insurance carrier that matches the sophistication of your car. Policies that offer Agreed value and robust temporary rental vehicle limits for your vehicles and collector cars help you avoid out of pocket expenses when a claim happens.

- Having the flexibility to use an auto body shop that has the appropriate equipment, licensed staff, and original equipment manufacturer parts for the repairs are important not only for the vehicle safety features but also, so you don’t void out any vehicle warranties.

3. Investing in Home Resiliency to Mitigate Catastrophic Weather Risks

The Growing Threat of Extreme Weather

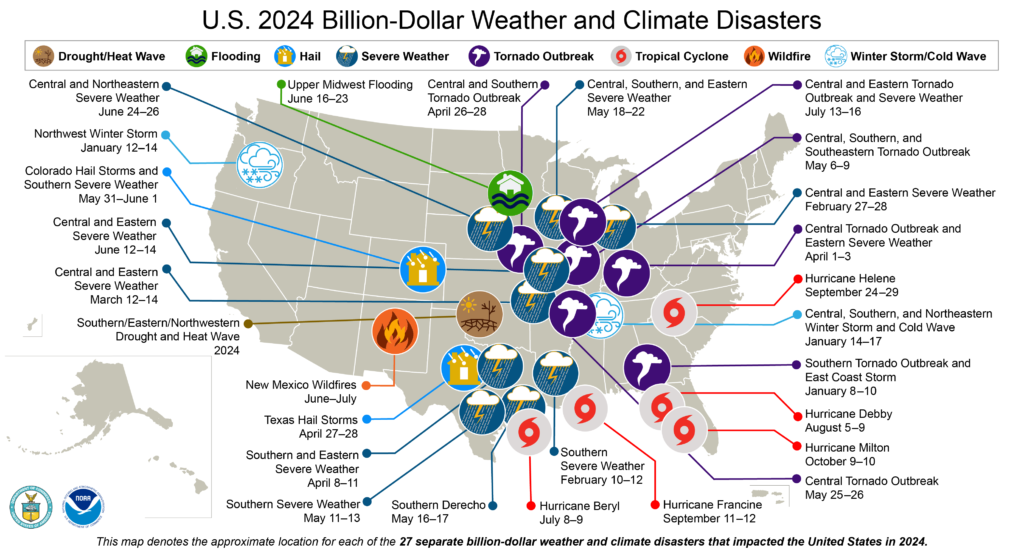

Hurricanes, wildfires, and other climate-driven disasters are occurring with greater frequency and severity. HNWIs must proactively fortify their properties to reduce risk exposure and secure better insurance terms.

Home Resiliency Investments That Matter

- Fire-resistant materials & ember-resistant vents (critical in wildfire-prone regions).

- Hurricane-rated windows, reinforced roofs, and flood engineering considerations (for coastal and storm-exposed properties).

- Backup power solutions (such as whole-home generators) to maintain security and prevent losses.

Insurance Benefits of Proactive Resiliency

Carriers are increasingly offering premium discounts and favorable terms for policyholders who invest in risk mitigation strategies, making these upgrades financially strategic.

4. Flood Insurance Trends & Rising Exposure Risks Related to Protecting Your High-Net-Worth Assets

Expanding Flood Risk Beyond FEMA Flood Zones

It’s important to remember that low risk does not mean no risk. Climate change is driving unexpected flooding in areas previously considered low-risk which is driving this as a needed component of a family’s insurance portfolio. According to recent studies, over 25% of flood insurance claims now come from properties outside FEMA’s designated high-risk zones.

Challenges with National Flood Insurance Program (NFIP) Coverage

- NFIP policies cap coverage at $250,000 for dwellings and $100,000 for contents, which is far below the needs of HNWI’s homes.

- FEMA’s Risk Rating 2.0 has led to significant premium increases, making private flood insurance a more attractive option.

Solution: Private Flood Insurance & Excess Flood Coverage

- Private flood carriers offer higher limits and more flexible terms.

Excess flood policies provide coverage beyond NFIP caps, ensuring full protection.

5. Shifts in the Real Estate Market & Their Insurance Implications

Market Trends Affecting HNWIs

- HNWIs continue to purchase homes in high-risk areas.

- Coastal and wildfire-prone areas face increasing insurance challenges, leading some homeowners to relocate.

- Carriers are reevaluating underwriting criteria, with some withdrawing from high-risk regions altogether.

Impact on Insurance Strategies

Properties in high-risk zones may require specialty insurance markets.

Multi-property owners should consolidate policies with high-net-worth specialty agents and insurers to optimize coverage and costs. By leveraging the entire insurance program, terms become more favorable and create consistency with holistic coverage and risk management philosophies.

The earlier you can discuss a potential new property purchase with your insurance agent, the better so they can provide important home risk characteristics to consider and contemplate the best possible insurance and risk management options available.

6. Insurance Market Adjustments Post-Palisades and Eaton Wildfires

The Fallout of the Wildfires

The Palisades and Eaton wildfires were a stark reminder of the increasing wildfire risk for affluent homeowners, particularly in California and other fire-prone states. In the aftermath:

- Insurers tightened underwriting standards, with some carriers ceasing to write new policies in high-risk zones.

- Premiums are increasing for existing policyholders.

- Non-renewals increased, forcing homeowners to seek coverage through surplus lines carriers.

Solutions for HNWIs in High-Risk Fire Zones

- Work with specialized high-net-worth insurance carriers that understand the unique needs of affluent homeowners.

- Implement fire mitigation strategies (e.g., defensible space, home hardening) to maintain insurability.

Conclusion: A Proactive Approach to Insurance for Protecting High-Net-Worth Assets

As risks evolve, high-net-worth individuals must take a proactive approach to insurance planning to protect their wealth, properties, tangible assets, and personal liability exposures. Key takeaways include:

- Umbrella liability coverage is essential to shield against nuclear verdicts.

- Insuring your home to value and reassessing when renovating are necessary to prevent underinsurance.

- Investing in home resiliency mitigates catastrophic weather risks.

- Flood insurance must be evaluated beyond FEMA guidelines.

- Shifts in real estate markets require tailored insurance solutions.

- Post-wildfire insurance challenges necessitate specialized underwriting and risk mitigation strategies.

By partnering with an experienced high-net-worth insurance advisor, clients can secure comprehensive, customized coverage that adapts to an increasingly complex risk environment.

Would you like further insights into any of these topics or assistance in reviewing your current coverage? Reach out to our office to discuss!

Interested in learning more? Check out our Insights page for other relevant education topics.