Get Appointment

- contact@wellinor.com

- +(123)-456-7890

Brewery Insurance

Craft breweries and brewpubs have become very popular in recent years. These businesses face unique challenges that require tailored brewery insurance programs.

How Are Brewery Insurance Programs Customized for Breweries and Brewpubs?

Historically breweries and brewpubs, could get property and liability coverage under traditional package insurance policies. In recent years, a number of carriers have developed policies that are customized specifically for these businesses.

These brewery policies include the core elements of building property coverage for owned or leased locations, contents coverage for furniture and equipment, and general liability coverage. However, they also include specific categories that breweries and brewpubs need to protect their assets. These include:

- Boiler and Machinery Coverage

- Supply Chain Coverage

- Spoilage and Product Recall

- Liquor Liability

- Key Employee Replacement Expense

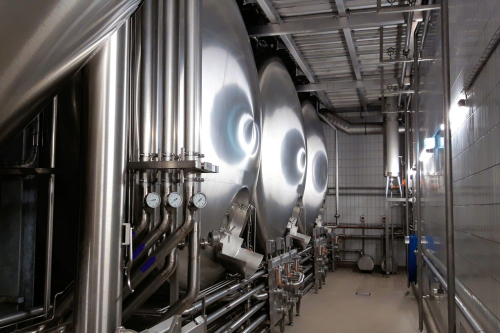

Boiler and Machinery Coverage for Breweries

Boiler and machinery coverage is crucial for repairing or damage equipment that is key in the manufacturing and bottling process. This coverage can help reimburse income lost because of product interruptions or downtime.

Brewery Insurance and Supply Chain Coverage

Supply chain coverage is also a key element for a brewery’s insurance program. Many brewers do not keep large amounts of ingredients on hand. They rely on their core suppliers for regular shipments of various elements used to produce their beer or spirits. Supply chain coverage can pay for losses resulting from decreased production or increased production costs from these suppliers in the event the brewery is unable to source the right materials.

Spoilage and Product Recall Coverage

Spoilage or product recall coverage is another core piece of brewery specific insurance policies. If a batch of beer is contaminated during brewing or packaging, this coverage can pay for lost revenue. It will reimburse for beer that is destroyed due to the contamination and can also pay for the cost of the recall and replacement if the brewery distributes beer and must remove its product from store shelves.

Liquor Liability Insurance for Breweries & Brewpubs

Liquor liability is an important piece if the brewery allows onsite consumption. It protects the brewery if a patron is injured or injures someone else and alleges they were overserved or served improperly. This type of liability coverage is typically excluded under a basic general liability policy and so it is crucial the brewery understands whether this component is included in the policy.

Key Employee Replacement Expense Coverage

Key employee replacement coverage can step in if a key employee dies or becomes disabled and unable to work. This clause will pay for expenses sustained in finding a replacement employee, including the cost of advertising the position, costs associated with interviewing potential individuals, and costs related to verifying the background of the applicants.

Brewery Insurance Conclusion

It is important for any brewery or brewpub to understand what elements are included within their insurance policies to ensure proper protection of their business.

Have any questions or want to discuss brewery insurance in more detail? Let’s chat!