With Pittsburgh being hit with significant rainfall within the last few months, multiple flash flooding events within days of each other, and Washington Boulevard’s repeated closures, it is more evident than ever that flood coverage is an important topic for discussion — no matter where you live.

We want to reach out to our valued Chubb clients to reiterate the importance of contemplating flood coverage and to provide you with some additional resources and information.

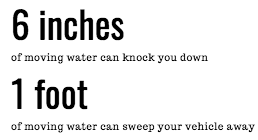

Flood waters do not have to come from a rising river, stream, or lake to be considered a flood event. Surface water can accumulate quickly and it doesn’t take much of a grade change to give that body of water momentum. While it may seem unlikely that flooding would happen in non-coastal areas, statistics indicate otherwise.

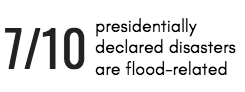

According to Federal Emergency Management Agency, 20% of flood claims happen to properties that are outside high-risk flood zones and floods and flash floods happen in all 50 states. (floodsmart.gov) Pennsylvania, in particular, is one of the top five worst states for flood.

Water can enter a home in many ways. Understanding how it is entering the home helps to determine how your home policy will and will not respond and how adding a flood policy could help to avoid out of pocket expenses.

With Chubb, if the water is backing up through the sewers and drains within your home, your homeowners policy would cover the damage expenses. If the water entering your home is caused by surface water, a flood policy would be needed to cover the loss.* If your home has water seeping through the seams of the floor and wall, your homeowner policy would not cover this and it would be a good time to discuss alternative risk management tactics and waterproofing your basement.

Every scenario is unique and your dedicated Private Client Services Account Manager can be a valuable first call in the event of water damage to figure out what needs to be done both from a claims handling perspective and initiating the remediation process with one of our trusted restoration companies.

Until recently, flood insurance was only available through the federal government via the NFIP. Chubb provides broader coverage than what you could get through the NFIP as a benefit for having your home and wind coverage through Chubb. They provide a brief overview of some of the benefits in this video and some of the highlights are also listed here.

With Chubb Flood, you would have these valuable benefits:

- Admitted paper, Chubb claims, & one adjuster

- Broader coverage including Replacement Cost versus Actual Cash Value

- Capacity – up to $15 million (building & contents)

- Definition of Flood: Chubb defines a flood to include loss confined to insured property

- Broader basement coverage than the NFIP:

- Contents up to $15,000 i.e. furniture, rugs, home theater systems, pool tables, and other contents typically found in a finished basement. This limit can be increased for an additional premium. (NFIP restricts coverage to specific items including washing machines, dryers, freezers, etc.)

- Real Property up to $30,000 for built in finished basement characteristics such as cabinetry, wet bars, saunas, etc. This limit can be increased for an additional premium. (NFIP restricts coverage to specific real property such as central a/c, furnaces, stairs, water softeners, etc.)

- Additional Living Expense includes $7,500 with limits up to 50% of the flood building limit available. (NFIP provides zero Additional Living Expense coverage)

- Rebuilding to code can be bought up to 25% of the flood building limit

If you are interested in learning more about a flood policy or determining if you are eligible for the Chubb flood product, please reach out to your dedicated Account Manager to discuss your flood concerns and see if the Chubb Flood product makes sense for your home.

Aside from insurance coverage, there are risk mitigation and risk avoidance tactics to consider that can lessen the severity of a loss before, during, or after damage is done. Chubb provides great tips and recommendations to keep you and your possessions safe. In addition to these recommendations, we collaborated with Kevin Young from Restoration Management Services to provide the following additional preventative measures that can be taken to avoid or reduce the risk of a water loss:

- Make sure downspouts drain away from the house and that the downspout drains are not clogged, which can allow for backups.

- Ensure that gutters are clean and free of debris and flowing properly. If not, this can allow for the gutters to overflow and deposit additional water to the foundation.

- Make sure that landscaping and soil is sloped away from the foundation. This will allow for water to drain away from the home.

- Installation of a sump pump will move water out of the system to the exterior of the house.

*Note that this is a general coverage overview and whether or not coverage would apply will depend on the specifics of the claim submitted and the terms and conditions of your in force policy at the time of loss.

About the Author:

Jessica Stoecklein DeFelice is the Director of Private Client Services at Simpson|McCrady and has been assisting high net worth clientele and providing education on their personal insurance and risk management needs since 2006.